In the trucking and related industries, trip accounting is often regarded as a technical and less common aspect, but it holds the key, almost invisibly, to whether drivers, owner-operators, or small fleets make money or not. Almost everyone tries to calculate gross revenue, miles per week, or per-mile rates, yet these figures are alone, insufficient to present the true picture. Without using the trip accounting templates that thoroughly delineated expenses, fuel, downtime, and margin, no meaning can be attached to profit. A truck can cover a huge distance and still end up with negative earnings if expenses are not classified and tracked properly at the trip level.At the trip level, accurate tracking of trip expenses combined with structured downtime management is what ultimately determines whether a run generates profit or silently erodes it.

What Trip Accounting Really Means in Trucking

Trip accounting is a unique method involving the documenting and examining every finance-related item that connects with one run or a specific period. Instead of going through monthly or annual statements, trip accounting condenses the focus to a single trip on a thus-time basis. It is easier to settle the discrepancies of the transport expenses, reduce the waste faster, and to put the abstract transportation costs into concrete numbers that can be controlled with this method than to do these things without it.

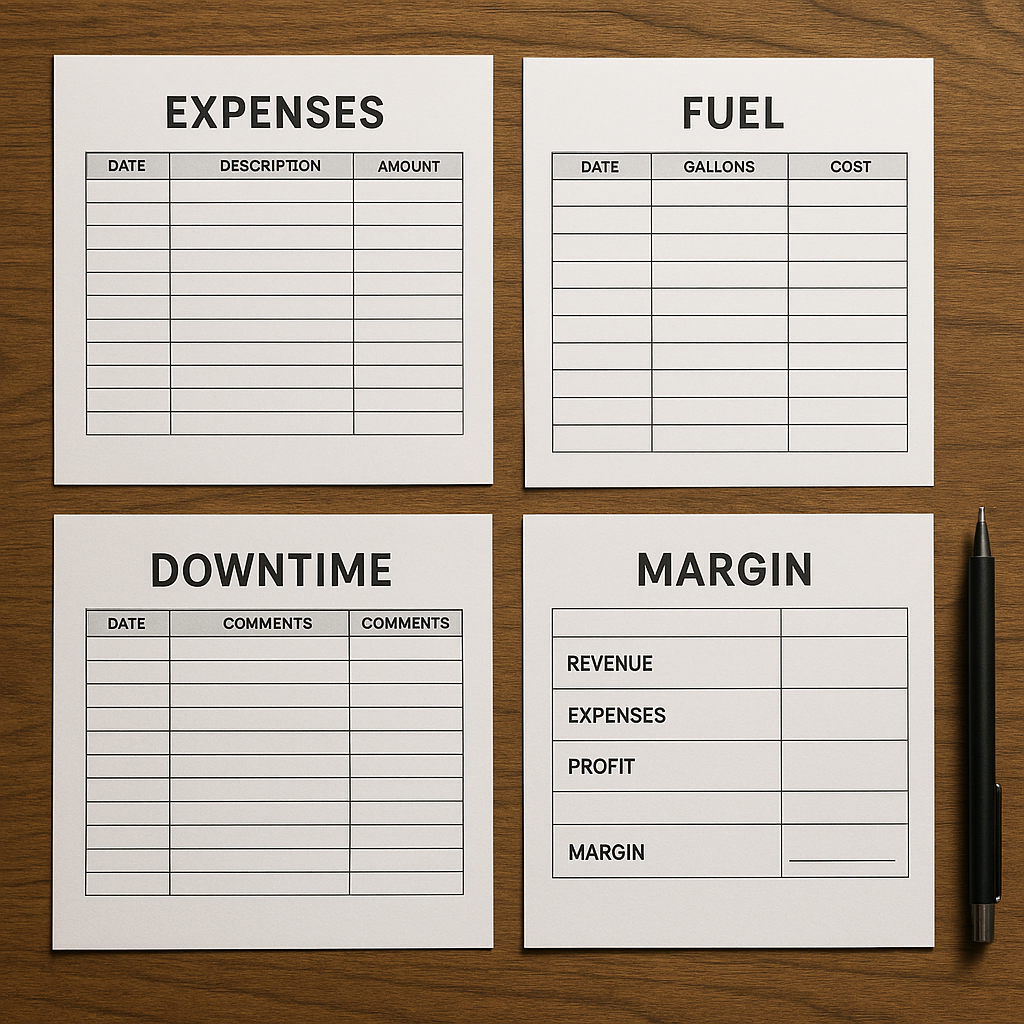

Fuel, waiting time, tolls, repairs, and unpaid downtime are the main operational events that help the drivers and fleet managers of trucking companies put a picture of how the operation looks in terms of finances. Management of trip accounting involves using accounting templates that are helpful to the drivers and fleet managers by showing to them where the money comes from and where it goes.

Trip Expenses and Cost Visibility

Trip expenses are the first layer that must be documented accurately. These include both obvious and hidden costs. Obvious expenses are easy to remember: fuel, tolls, parking, and maintenance. Hidden expenses often go unnoticed like: idling fuel during downtime, paid parking while waiting for a dock, food expenses during extended delays, and opportunity cost when a truck sits still. Trip expenses become meaningful only when they are later summarized into structured expense reports. These reports turn scattered receipts into a single financial picture and play a direct role in cost control, helping drivers and operators see which expenses are unavoidable and which ones are preventable on a trip-by-trip basis.

Fuel Tracking as a Core Variable Cost

Fuel tracking is of paramount significance since the fuel cost makes up the bulk of the variable costs incurred in trucking. Fuel prices are variable on a day to day basis, routes are different and driving tactics are directly proportional to fuel consumption. Fuel tracking in trip accounting must extend beyond just the total gallons to be gathered. It has to relate the gallons used to mileage, idle time, terrain difficulty, and traffic conditions. In the absence of this information, fuel numbers are mere receipts, not data.

Downtime Management and Driver Downtime

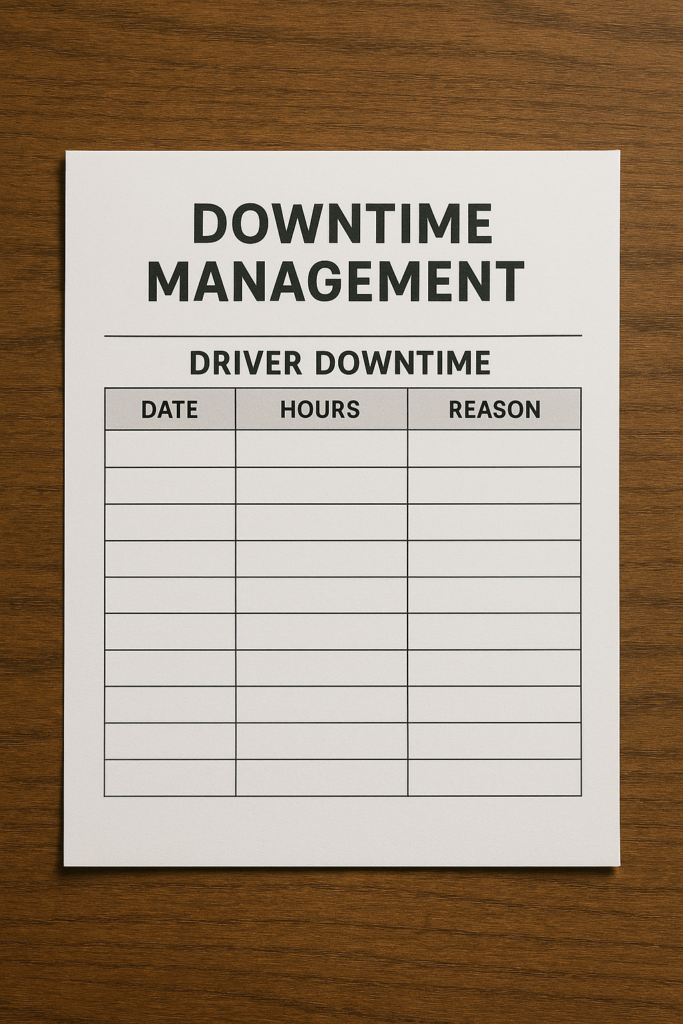

Aside from tracking symptoms that create problems with downtime, one also needs to understand the reasons that cause downtime. Drivers’ unpaid hours due to waiting for shipment, being stuck at a receiver, and having poor scheduling which can, in turn, increase truck margins are some examples. The trip accounting template that ignores downtime is like the “profitable illusion” that looks like it is fine by just counting miles driven and expenses paid but actually includes time wasted. Downtime management starts with recognizing driver downtime as a measurable operational cost rather than an inconvenience. When driver downtime is logged consistently inside trip accounting templates, it becomes possible to identify repeating causes and reduce the financial damage caused by unpaid waiting time.

Margin Analysis at the Trip Level

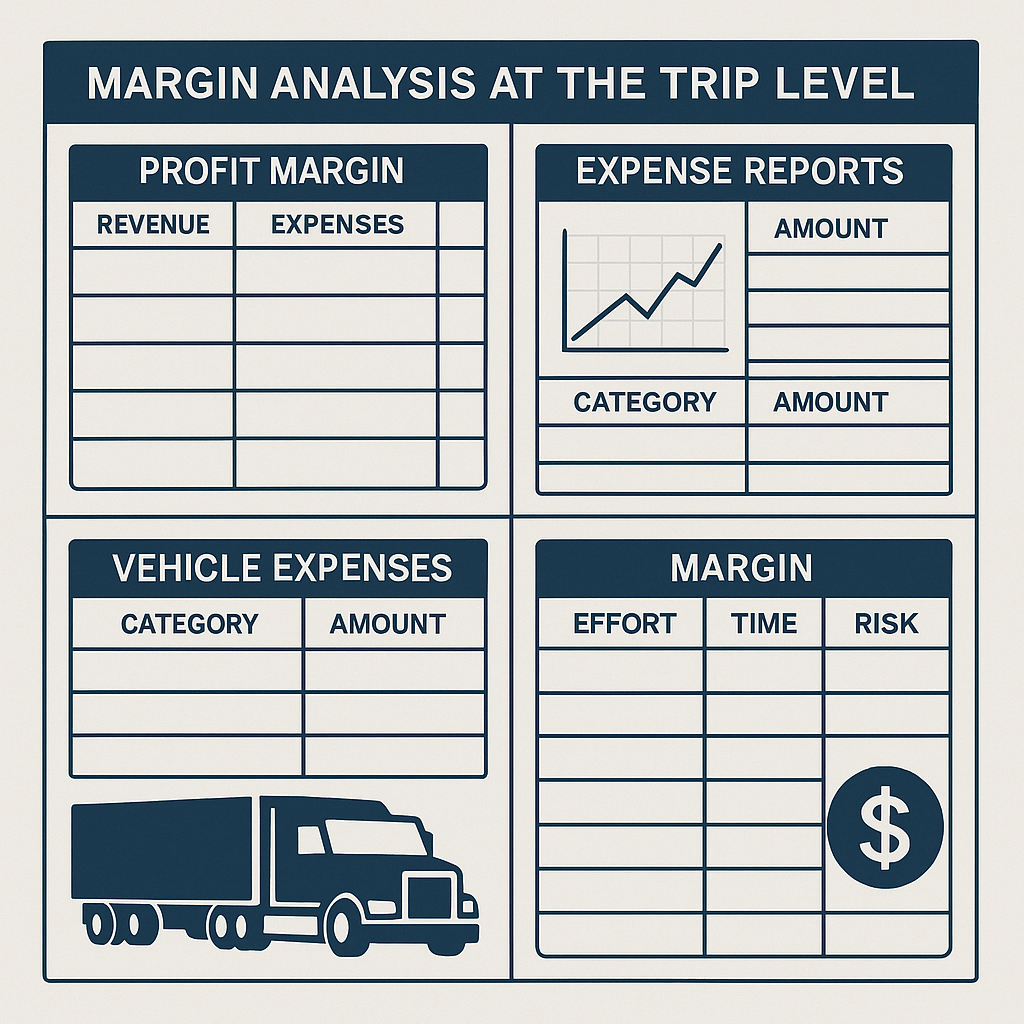

Margin analysis ties everything together. In trucking, profit margin does not only involve the assumptions of revenue and expenses. It refers to the interplay of effort, time, risk, and return. A scenario could involve a truck coming with a high gross rate but suffering excessive downtime that finally leaves the driver with a weaker margin than if traveling a less lucrative but efficient route. Margin analysis essentially in trip accounting enables operators to judge the trips without feeling emotional about it.

Expense Reports, Vehicle Costs, and Fleet-Level Accounting

Expense reports from trip accounting templates serve a multitude of purposes across both individual trips and broader fleet operations. They ease tax preparation, support cost control, and help identify recurring patterns. Over time, consistent expense reports reveal trends such as rising vehicle-related expenses, repeated repairs, and routes that underperform on a regular basis. This information becomes a strategic asset rather than administrative paperwork.

Beyond fuel monitoring, vehicle expenses include many cost components that are often overlooked in daily operations. Tires, oil changes, unexpected breakdowns, depreciation, insurance, and compliance-related costs all contribute to operational expenses. Monthly averages may appear stable, but they often conceal underlying volatility. Trip accounting exposes these variations by distributing vehicle expenses more accurately over time instead of smoothing them out artificially.

Mileage tracking connects these expenses to performance. Operationally, it reflects distance traveled; financially, it serves as the base for cost-per-mile, fuel efficiency, revenue per mile, and margin calculations. Even small inaccuracies in mileage tracking can distort logistics accounting and lead to misleading conclusions about profitability.

Bookkeeping for Transportation & Logistics Industry Explained

At the same time, fixed and operational expenses frequently overlap between trips, making proper allocation essential. Costs such as insurance premiums, truck payments, and permits are not tied to a single run, so accounting templates distribute them using mileage, time, or revenue as allocation bases. When fixed costs are underestimated or ignored, the true cost of a trip is misrepresented.

At scale, this entire process supports effective fleet management. Standardized trip accounting across multiple trucks creates a shared financial language, allowing operators to compare routes, vehicles, and driver behavior using the same profitability metrics. Without this standardization, performance comparisons rely on intuition and incomplete summaries rather than consistent data.

Business Travel Expenses in Trucking Operations

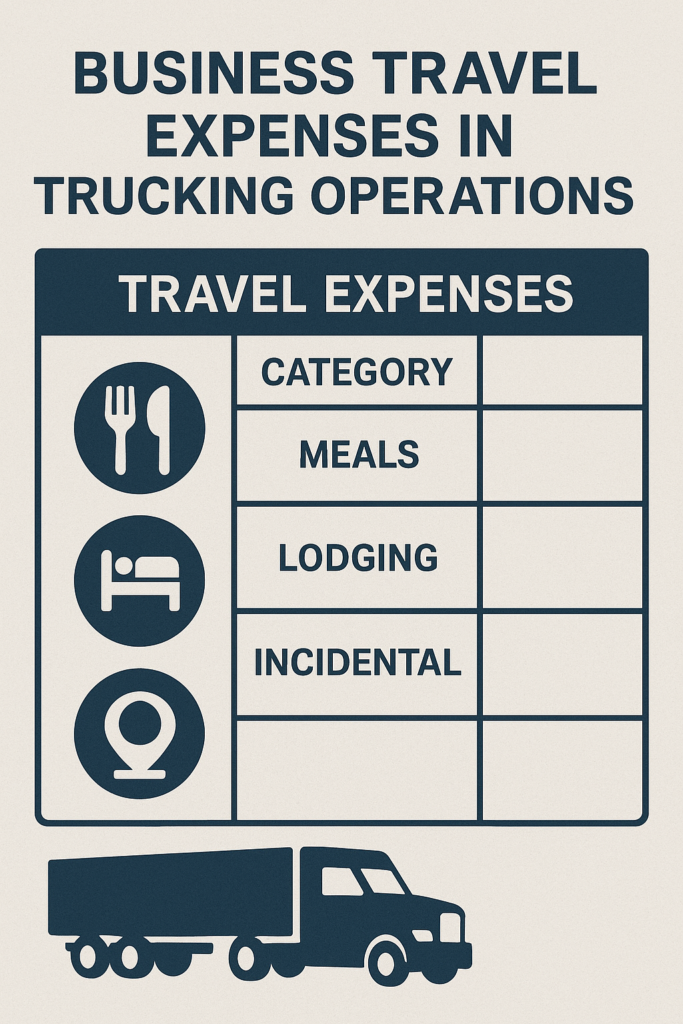

In trucking, travel expenses are not the same as in the corporate, yet, the accounting principle is still one and the same that is, each and every expense must be justified against the value created. For example, meals incurred during the stay at breaking points along with incidental expenses should be recorded together with operational data. They usually drain off margins, unnoticed, for a long time. In this context, business travel expenses such as meals during extended delays, lodging caused by breakdowns, or incidental road costs should be treated as part of trip accounting rather than ignored, since they quietly influence the final margin of each run.

Financial Templates and Practical Simplicity

Financial templates should exhibit clarity not complexity. Overly complicated spreadsheets act as disincentives to their use. The aim of the templates is not to attain a faultless level of accounting but to provide action-oriented information. Simplicity is the key template method to generate earning, losing, and the reasons why. Well-designed financial templates support decision-making by linking operational behavior with financial outcomes, allowing drivers and fleets to see how everyday actions translate into measurable profit or loss.

Cost Control Through Visibility

Cost control coming from good trip accounting is an organic turn. The visibility of expenses at the trip level leads to the discomfort of waste. Drivers are the ones who notice unnecessary idling, inefficient fueling habits, and avoidable toll routes. Cost control is no longer a theoretical concept but rather a habit of daily practice. Over time, this visibility strengthens cost control discipline, as repeated exposure to trip-level numbers encourages more deliberate fueling, routing, and time management decisions.

Profitability Metrics That Reflect Reality

Profitability data taken from trip accounting is far more accurate than aggregated averages. The figures like the net profit from the trip, margin per mile, and revenue on an hourly basis show the ground realities better than the total monthly revenue. Those metrics can aid in better loads and scheduling decisions.

Expense Reconciliation and Data Accuracy

The final part of the equation is the expense reconciliation step which is the one that ensures the accuracy of the overall task. All receipts, fuel statements, ELD data, and dispatch records must correspond with each other. Trip accounting templates that make the reconciliation easier lead to lesser errors and make sure that there is no financial blindness. Over time, the practice of reconciliation reinforces the trust in the data.

Expense Categories Overview

In brevity, the budget associated with borrowed equipment is not accountancy separate from that of owned equipment, which means that the costs fixture on the borrowing equipment. Include repairs, maintenance, parts, labor, etc. Overhead associated with an operation facility that is idle is not a deduction from the revenue.

- Revenue: Examples: Initial payment, monthly installments

- Equipment expenses: Examples: fuel, maintenance, and repairs

- Operating expenses: Examples: Rent, utilities, insurance

Trip Accounting Structure Example

The trip record below incorporates the conventional structure for trip accounting elements as they are usually grouped:

| Category | Example Items | Notes |

| Revenue | Linehaul pay, accessorial pay | Gross before expenses |

| Fuel | Gallons, total cost, cost per mile | Linked to mileage |

| Trip Expenses | Tolls, parking, scales, food | Variable per trip |

| Downtime | Waiting hours, unpaid delays | Time based loss |

| Vehicle Expenses | Maintenance allocation, tires | Proportional share |

| Net Result | Profit or loss | Margin analysis |

The above table conveys the cost of transportation which could be controlled through the structuring of data in a logical manner. Each row in the table is a kind of lever that could be moved about or optimized.

FAQ

1. What are the most common trip accounting mistakes?

The prevalent mistakes in trip accounting are often because of inconsistency. A driver could follow all the procedures to the letter as far as the fuel thing is concerned but, otherwise, get it all with downtime. Some others record expenses but miss out on allocating fixed costs. These oversights make the profitability measures distorted and lead drivers to err.

2. How can drivers avoid errors in trip accounting?

To avoid these pitfalls, effective trip accounting relies on a few disciplined practices:

- Recording expenses daily instead of weekly

- Logging downtime hours with reasons

- Tracking fuel alongside mileage

- Allocating fixed costs consistently

- Reviewing margin analysis after every trip

These habits turn accounting from a chore into a feedback system.

3. Why does fuel tracking require more than receipts?

Fuel tracking can be made better with qualitative notes. For instance, the weather was bad, there was traffic and the terrain was difficult, etc. These explanations will tell you why fuel efficiency will be different on similar routes.

4. How should driver downtime be recorded?

Driver downtime is managed effectively when downtime is tagged. For example, waiting at shippers, mechanical delays, traffic accidents, and regulatory holds should be logged separately. Each category suggests different corrective actions. Trip accounting templates that include downtime categories enable targeted solutions instead of vague frustration.

How different trip accounting elements interact

| Accounting Area | What Is Tracked | Why It Matters |

| Fuel Tracking | Fuel usage, mileage, driving conditions | Explains cost-per-mile variation |

| Downtime Logging | Waiting time, delays, stoppages | Protects profit margin |

| Expense Allocation | Fixed and variable costs | Prevents distorted profitability |

| Margin Review | Net profit per trip | Supports route comparison |

5. How does margin analysis improve trip decisions?

Margin analysis becomes beneficial only when it is compared between the trips. A single trip that looks good sometimes may have hidden problems that only the patterns can show. Low-margin, consistently unprofitable routes should be re-evaluated or avoided altogether. Routes with high margins should definitely be replicated.

6. How do expense reports help in negotiations?

Expense reports generated from trip accounting help the negotiating process with brokers and shippers. Evidence produced by data is more weighty than verbal accounts. If a driver could prove that the downtime reduces the margin, the requests for accessorial become more credible.

7. Why is standardization important in logistics accounting?

Standardization in trip accounting template becomes establishment in logistics accounting at scale. Otherwise, fleet data becomes fragmented and information operating expenses, fuel tracking, and margin analysis does not align into a coherent system.

8. How should mileage tracking be handled?

Mileage tracking should become an integration of odometer readings, ELD data, and routing software. Discrepancies between these sources signal data quality issues. Reliable mileage data stabilizes all downstream calculations.

9. How do seasonal changes affect trip accounting?

Operational expenses change with seasons. Predictably, winter driving consumes more fuel and incurs more maintenance costs than summer heat affecting tires and cooling systems. As a result, expenses are more in line with their seasonal variation through trip accounting.

10. How should fleet-level decisions be made using trip data?

Fleet management decisions such as equipment upgrades, route changes, or driver incentives should be informed by trip-level profitability metrics. Aggregated numbers obscure the effects of individual operational choices.

11. How can business travel expenses be controlled?

Business travel expenses are easiest to control when tied to outcomes. If extended downtime increases meal costs, the root cause is not food prices but scheduling inefficiencies. Trip accounting connects symptoms to causes.